Finanzielle Bildung für Kinder und Jugendliche

Unsere Mission: Junge Menschen für den Umgang mit Geld begeistern.

Unsere Mission: Junge Menschen für den Umgang mit Geld begeistern.

Informiere Dich jetzt und melde Dich einfach.

Jetzt mehr erfahren und am besten gleich Termin anfragen.

Schreib uns ganz einfach.

"Unser Herz schlägt für Kids und Jugendliche. Damit Kinder nie mehr vergessen, wie großartig sie sind und wieviel Gutes sie mit Geld bewirken können."

Wie wäre es, wenn Du weißt, wie Du immer mehr als genug Geld hast?

Schritt für Schritt Deinen Geldsack füllen.

Wie das funktioniert?

Das erfährst du in einem unserer Workshops.

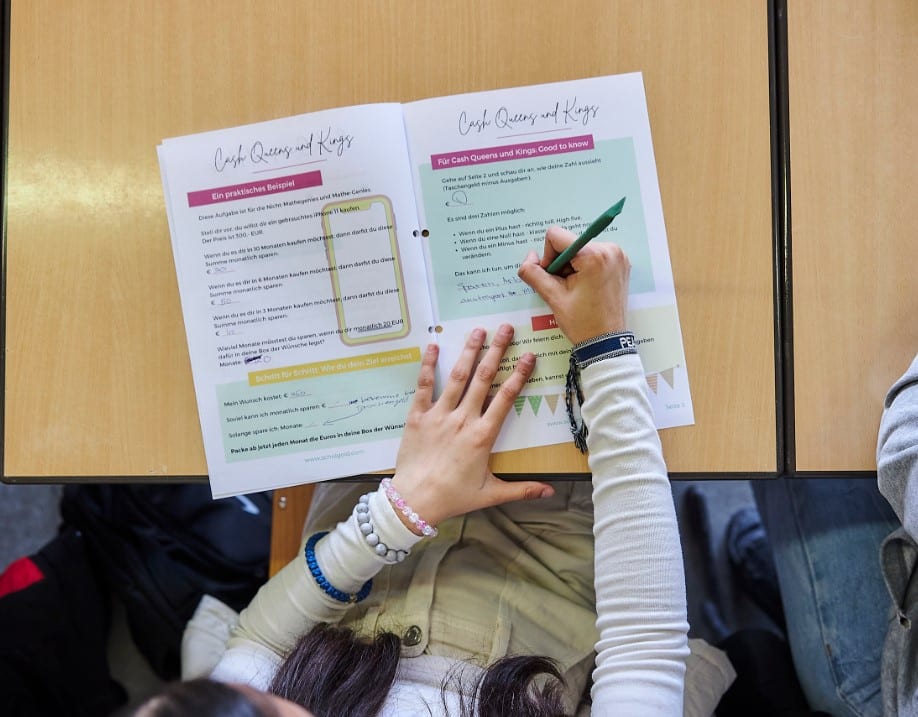

#cashqueen #cashking

Sparen, für das, was dein Herz hüpfen lässt.

Stell dir vor, du weißt, wie das mit dem Sparen funktioniert?

Und du kennst die Geheimtipps, wie du immer Geld hast.

Alles, was am Anfang schwer ist, wird irgendwann leicht. Das ist wie mit Handstand-Üben.

Irgendwann stehst du einfach. Das und noch mehr machen wir gemeinsam mit dir in unseren interaktiven Workshops.

#geldchecker

Mehr als 2000 Jugendliche und Kinder haben bereits an unseren Workshops teilgenommen.

„Ich fands cool, dass wir über Geld gesprochen haben.“

„War alles top, hat Spaß gemacht. Supi!"

"Ich habe jetzt endlich verstanden, warum die Döner plötzlich so viel kosten."

"Ich hab jetzt kapiert, warum keine Schulden machen so wichtig ist."

Lass uns gleich loslegen.

Tragt Euch jetzt ein und bekommt sofort und kostenlos das interaktive Workbook mit 4 spannenden Finanzchallenges für Euch und Eure Kids. [Wir schicken Euch Neuigkeiten und exklusive Einladungen. Kein Spam, Ihr könnt Euch jederzeit wieder abmelden.]

“Das Schulgold Team bringt mit seiner zugewandten Art die Faszination für das Thema Finanzen ins Klassenzimmer.

Meine Schülerinnen und Schüler waren motiviert, ihren persönlichen Umgang mit Geld zu reflektieren und konnten auch noch Wochen später zentrale Aussagen des Trainings wiedergeben.

Das Schulgold Programm schärft das finanzielle Bewusstsein von Jugendlichen und ergänzt damit schulische Bildung bei einem wichtigen, aber oftmals vernachlässigten Thema.

Quelle: FCA; Goldman Sachs, Glücksspielkommission, 2019

Studien zeigen, dass jungen Menschen im Alter zwischen 18 und 24 offen sind, Kredite mit hohen Zinsen aufzunehmen.

45% der Eltern sind besorgt, dass ihre Kinder Schulden machen.

70% geben ihr Geld sofort für Konsum aus.

70% haben bereits Spiel-Erfahrungen gesammelt.

Tragt Euch jetzt ein und bekommt sofort und kostenlos das interaktive Workbook mit 4 spannenden Finanzchallenges für Euch und Eure Kids. [Wir schicken Euch Neuigkeiten und exklusive Einladungen. Kein Spam, Ihr könnt Euch jederzeit wieder abmelden.]

Input your search keywords and press Enter.